CHINA DAILY

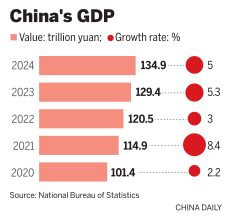

China's gross domestic product expanded 5 percent in 2024, official data showed on Friday, which is in line with the country's preset target of around 5 percent and provides a solid base for stabilizing the economy this year.

Economists said China's economy will likely continue to grow at around 5 percent this year if the government adopts more expansionary moves for macroeconomic adjustment to boost domestic demand.

In addition, economists said they expect more policy easing in 2025 to offset the headwinds from a more complicated and grimmer external environment, with the shift toward consumption-driven and high-quality growth seen as the key to fostering the economy's endogenous growth momentum.

The country's annual GDP came in at 134.9 trillion yuan ($18.4 trillion) in 2024, data from the National Bureau of Statistics showed on Friday. In the fourth quarter of last year, the Chinese economy grew 5.4 percent year-on-year, following 4.6 percent growth in the third quarter.

"China's GDP for the first time surpassed 130 trillion yuan last year, maintaining its position as the world's second-largest economy," Kang Yi, head of the NBS, said at a news conference in Beijing on Friday. "China is among the top ranks of major economies in terms of annual growth rate, and it continues to serve as a key growth driver for global economic growth."

Citing the latest economic indicators, Jeremy Zook, lead analyst for China at Fitch Ratings, said China's economy rebounded more than anticipated in the fourth quarter on the back of a step-up in fiscal stimulus and strong export performance.

"This has created positive spillovers to industrial production activity, which performed well in December," Zook said.

NBS data showed that China's value-added industrial output grew 6.2 percent year-on-year in December, following 5.4 percent growth in November.

Zook noted that domestic activity remains a clear challenge for the economy, stemming from weak consumer confidence.

Retail sales, a key measurement of consumer spending, increased 3.7 percent year-on-year in December, compared with the 3 percent growth recorded a month earlier. China's fixed-asset investment rose 3.2 percent in 2024, and in the first 11 months it grew 3.3 percent.

As increasing external challenges from a likely rise in trade tensions with the United States may add to headwinds from the still subdued domestic demand, Zook said his team expects "a considerable step-up in fiscal policy in 2025 to help mitigate part of the impact from an expected rise in US tariffs and to help boost domestic confidence".

"Ultimately, the ability of fiscal policy in sustainably boosting domestic demand … will likely depend on whether it is effectively targeted to spur a recovery in household confidence," he added.

As part of the country's ongoing efforts to spur consumption, the Ministry of Commerce, together with several other central departments, issued a notice on Friday about extending the program for auto trade-in deals.

To provide an incentive for consumers to replace old vehicles with new ones, consumers who purchase new energy vehicles will be eligible for subsidies of 20,000 yuan, while those who purchase gasoline-powered passenger vehicles will be eligible for subsidies of 15,000 yuan, according to the new policy.

The National Development and Reform Commission announced earlier this month that the country will significantly increase the issuance of ultra-long-term special treasury bonds in 2025 to stimulate consumption and fund key national projects. In addition, it will extend the programs for large-scale equipment upgrades and trade-in deals for consumer goods and expand the scope to more consumption fields.

Louise Loo, lead economist at British think tank Oxford Economics, said, "With recent policy signals remaining decidedly dovish and authorities recognizing the importance of finding a sustainable growth engine, the coming months will likely feature more consumption-oriented stimulus."

Wang Tao, head of Asia economics and chief China economist at UBS Investment Bank, said she expects stronger macroeconomic policy support to be launched this year, with total government bond issuance likely to increase by more than 3 trillion yuan compared with last year, while the budgetary deficit-to-GDP ratio is likely to rise to nearly 4 percent, compared with 3 percent in 2024.

Wang also said that, apart from financing the investments of key projects and infrastructure, this year's fiscal stimulus may become more oriented to supporting consumption by boosting expenditures on pensions, medical insurance and childbirth subsidies, while doubling the support for trade-in deals for consumer goods.

With a package of incremental policies continuously taking effect this year and more policy easing in the pipeline, Zhang Yongjun, secretary-general of the China Center for International Economic Exchanges, said China's economy will likely expand by around 5 percent in 2025.