China's economy demonstrated strong resilience in 2025, with growth holding firm despite mounting external pressures and internal structural adjustments, while new growth drivers are taking shape to support sustainable expansion going forward, said officials and experts.

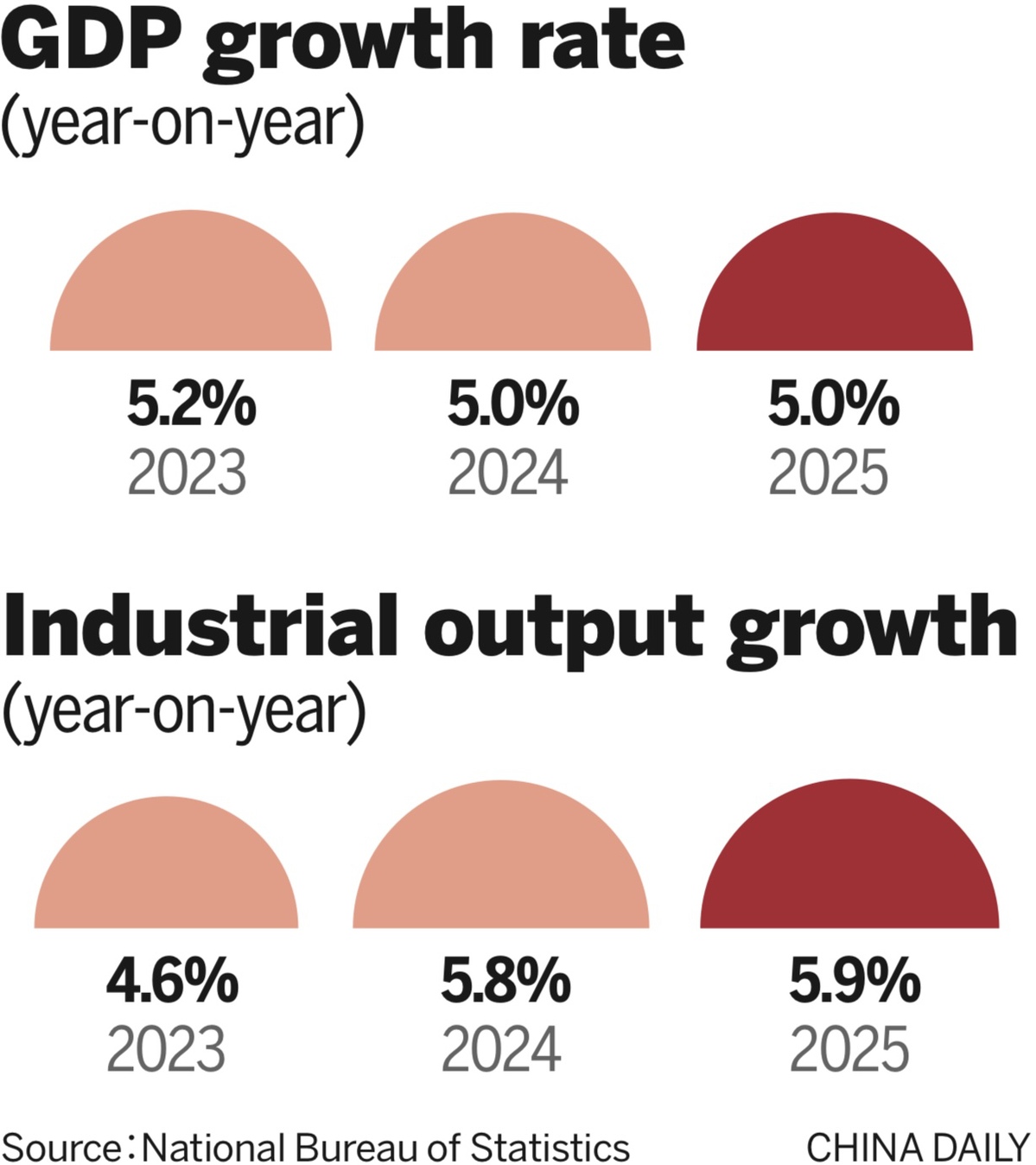

Official data released on Monday showed that China's gross domestic product grew 5 percent last year, meeting the country's annual target of around 5 percent. The hard-won performance, achieved amid heightened tariff pressures, has laid a solid foundation for a steady start to economic growth in 2026, reinforcing confidence that the world's second-largest economy remains on a stable trajectory.

As China enters the opening year of its 15th Five-Year Plan (2026-30) period, economists said policymakers are set to press ahead with front-loaded fiscal support to boost domestic demand, alongside a moderately accommodative monetary stance aimed at lifting prices and easing financing costs.

The country's annual GDP came in at 140.19 trillion yuan ($20.13 trillion) in 2025, according to the National Bureau of Statistics. In the fourth quarter of 2025, the Chinese economy grew 4.5 percent year-on-year, following 4.8 percent growth in the third quarter.

Kang Yi, head of the NBS, said that the latest indicators fully demonstrate the Chinese economy's steady progress, resilience under pressure, and vitality in moving toward higher-quality and innovation-driven development.

"China's average annual contribution to global economic growth stood at around 30 percent throughout the 14th Five-Year Plan (2021-25) period. With a complete industrial system, China has played a stabilizing role in global supply chains and injected much-needed stability into a world economy undergoing turbulence and transformation," he said.

Guan Tao, global chief economist at BOCI China, said that China's economy has delivered "hard-won" results in 2025, featuring breakthroughs in technological advances and emerging consumption phenomena, setting the stage for a 2026 GDP growth target possibly at 4.5 percent to 5 percent.

"In 2025, when people talked about China, things like DeepSeek, Ne Zha 2, Unitree humanoid robots, the overseas expansion of innovative pharmaceuticals, and Jiangsu Football City League, or Suchao, all showed that China's economy has been full of highlights, whether in consumption recovery or technological innovation," Guan said.

Citing the latest indicators, Sheana Yue, a senior economist at British think tank Oxford Economics, said that the fourth quarter's continued momentum appeared to be driven by stronger industrial activity and exports in December, which offset still weak domestic demand.

NBS data showed that China's value-added industrial output rose 5.2 percent in December, following 4.8 percent growth in November.

"Our estimates suggested high-tech manufacturing, including transport equipment, electrical machinery and electronics manufacturing, continued to outperform at the end of 2025," Yue said.

According to the NBS, retail sales, a key indicator of consumer spending, increased 0.9 percent in December, while China's fixed-asset investment decreased 3.8 percent in 2025.

Wang Qing, chief macroeconomic analyst at Golden Credit Rating International, said that looking ahead to 2026, the impact of high tariffs imposed by the United States on global trade and China's exports is expected to become more pronounced, weakening the contribution of external demand to economic growth and requiring domestic demand to step in more decisively.

"We expect that, with more proactive and effective macroeconomic policies continuing to gain strength, consumption will accelerate further in 2026, and investment will stabilize after bottoming out," he said.

With 2026 marking the opening year of China's 15th Five-Year Plan, Xu Hongcai, deputy director of the economic policy committee of the China Association of Policy Science, said that ensuring a smooth economic start will be critical, and called for stable, consistent and moderately forceful macro policies.

Fiscal policy should remain proactive, he said, suggesting that the fiscal deficit ratio remain at around 4 percent, supported by the continued issuance of long-term treasuries to boost consumption, improve public well-being and mitigate local government debt risks. He added that monetary policy should stay moderately accommodative, with room for further cuts to interest rates and the reserve requirement ratio.

Going forward, Xu said that China's economic growth in 2026 is expected to remain within a reasonable range, with improving quality, a more optimized structure and steady progress toward high-quality development.

Choi Yong-ho, chief executive officer and chief happiness officer of South Korean entertainment technology company Galaxy Corp, said China's market holds virtually unlimited development potential. "It is creative, innovative and dynamic, and it is already at the global forefront in multiple industries."

"China's strong capabilities in robotics and artificial intelligence are leading industrial development, and its younger generation represents a highly capable and promising talent base. With these advantages, I believe the Chinese market will continue to grow, with a very optimistic outlook," he said.