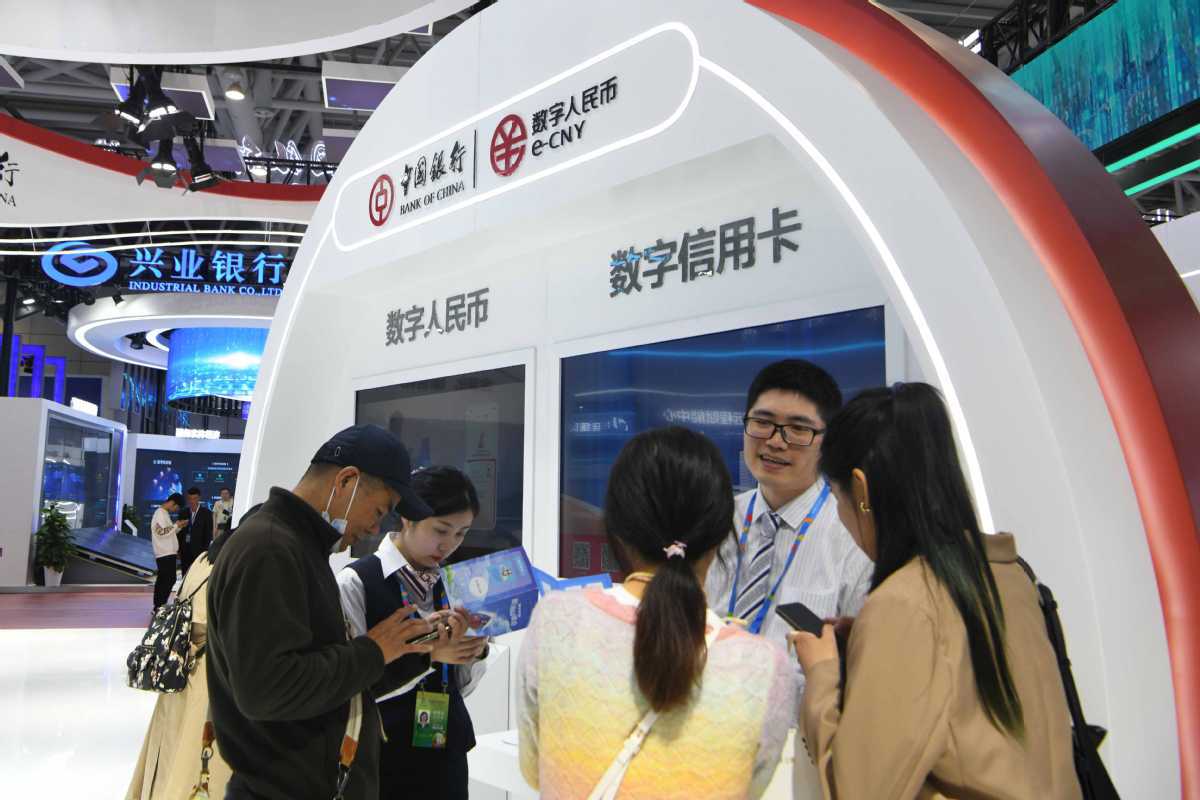

A view of the booth of Bank of China during an expo in Fuzhou, Fujian province. CHEN BIN/FOR CHINA DAILY

BEIJING — Bank of China will step up financial support to bolster high-quality development of private enterprises and facilitate their overseas expansion, as the private sector serves as a key engine driving China's economic development.

The lender has unveiled 20 targeted measures to support the high-quality development and global expansion of private enterprises, focusing on the inclusiveness, professionalism and innovation of financial services tailored to private businesses and providing efficient digital solutions.

BOC's move comes after China's central leadership called for concerted efforts to resolve the challenges and costly financing faced by private enterprises at a recent symposium on promoting the healthy and high-quality development of the private economy.

"BOC has pledged to ramp up financial support for private enterprises' deep participation in the Belt and Road Initiative, with enhanced service capabilities in cross-border financing, international settlement and overseas investment," said Ge Haijiao, chairman of BOC, at a news conference on Wednesday.

The bank will provide over $5 billion in financing for overseas projects of private enterprises this year, and the growth rate of loans to private enterprises will be 5 percentage points higher than the overall loan growth rate of the bank, said Zhang Hui, president of BOC.

By ensuring highly efficient global settlement services, BOC will facilitate cross-border e-commerce transactions. Leveraging its traditional strengths in areas such as export credit, the bank will deliver internationally competitive financing solutions to private enterprises, streamlining cross-border financing processes, it said.

"We will also provide full-cycle cross-border support to empower private enterprises' international operations, through enhancing services such as global cash management," said Zhang Xiaodong, vice-president of BOC.

The bank will optimize financial services tailored for small and medium-sized private enterprises and streamline online and offline loan renewal products for small and medium-sized businesses, enhancing financing convenience and accessibility for those private enterprises, it said.

"We will continue solving the issues of difficult and costly financing for private enterprises by leveraging more cutting-edge digital tools," the vice-president added.

BOC will assist private enterprises in strengthening equity financing support, expanding diversified financing channels and actively supporting the issuance of innovative financial bonds such as technology innovation bonds, to address their multidimensional needs, said Zhang Hui.

BOC said its investment arm BOC International has partnered with eight local governments and industry leaders to set science and technology innovation fund of funds, aiming to enhance financial support for technology.

Tan Guoling contributed to this story.