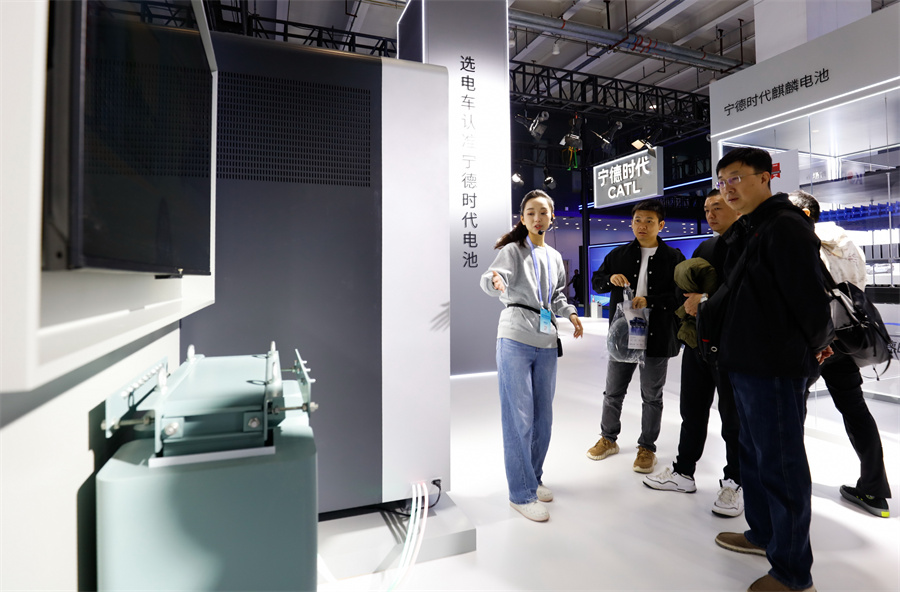

An employee addresses queries on all-solid-state batteries during a high-tech expo in Beijing in October. Embracing AI, Chinese battery makers are ramping up efforts to step up the mass production and installation of such batteries. [ZHANG HAIYAN/FOR CHINA DAILY]

Chinese battery players are joining forces, including leveraging artificial intelligence technologies, to accelerate the development of all-solid-state batteries, and targeting small-scale installations by 2027 and mass production by 2030, said industry insiders.

The latest goal comes as almost all leading industry players in the field of all-solid-state batteries — including battery manufacturers, automakers and scholars — participated in the second China All-Solid-State Battery Innovation and Development Summit Forum recently.

Ouyang Minggao, an academician at the Chinese Academy of Sciences, said the country's current route for all-solid-state batteries is to develop sulfide-based batteries, which, paired with high-nickel ternary positive and silicon-carbon negative materials, aim to achieve performance targets of 400 watt-hours per kilogram in energy density and life cycles of over 1,000.

"These advances are expected to facilitate the country's small-batch installation of all-solid-state batteries by 2027, with large-scale mass production projected by 2030," said Ouyang, who is also a professor at Tsinghua University.

To keep pace with the development of all-solid-state batteries, Ouyang said that in addition to building common supply chains for industry-wide base materials, it is essential to integrate large language models and AI for science-based endeavors.

He said his team has already collaborated with more than 30 related companies to conduct the development and optimization of large-scale models in the vertical field of all-solid-state batteries.

By leveraging AI large models for solid-state batteries, the system is now able to provide a variety of intelligent experts and intelligent design tools, which will enable intelligent matching of material systems, design parameters, smart optimization and process recommendations.

"The research and development efficiency of batteries can be greatly improved and the development costs can be reduced by 70-80 percent," he added.

All-solid-state batteries offer higher theoretical energy density and safety, and entail lower costs than lithium-ion batteries that currently dominate the electric vehicle sector. Hence, many countries consider them a potentially game-changing technology.

In a further sign of Chinese players' progress in the sector, Sun Huajun, chief technology officer of BYD Lithium Battery Co Ltd, the battery firm for China's largest EV maker BYD, said at the conference that the company plans to begin small-scale production of sulfide-based all-solid-state batteries by 2027, and these batteries are expected to be incorporated into its mainstream EV models by 2030.

This timeline places BYD in direct competition with global automakers investing heavily in such batteries, such as Japan's Toyota, which has been ramping up efforts in this field to take a lead.

Wang Deping, chief scientist of FAW Group, one of China's largest State-owned automakers, said that the company aims to achieve small-scale application of solid-state batteries by 2027.

Wang said China FAW has been dedicated to the development of all-solid-state batteries since 2014, aligning its research with the needs of the automaking sector.

Industry experts said that China adopts a dual-track approach to the development of EV batteries. It will keep improving liquid lithium-ion batteries to "maintain advantages globally", while intensifying R&D of all-solid-state batteries, to "prevent disruptions" by other countries, they said.

Miao Wei, former minister of industry and information technology, said at the conference that economies like the United States, Europe, Japan and South Korea are prioritizing the research and commercialization of all-solid-state batteries, aiming to leapfrog China's current power battery industry, while Chinese companies are ramping up their investments to safeguard their competitive edge.

"While technical challenges remain, cost is another key factor in the widespread adoption of solid-state batteries," Miao said.

He said material costs for a typical solid-state battery exceed 2 yuan ($0.28) per watt-hour, compared to 0.5 yuan per watt-hour for liquid lithium-ion batteries.

"This makes it far more expensive to produce solid-state battery packs. Thus, for the foreseeable future, liquid and solid-state batteries are likely to coexist in the market," Miao added.