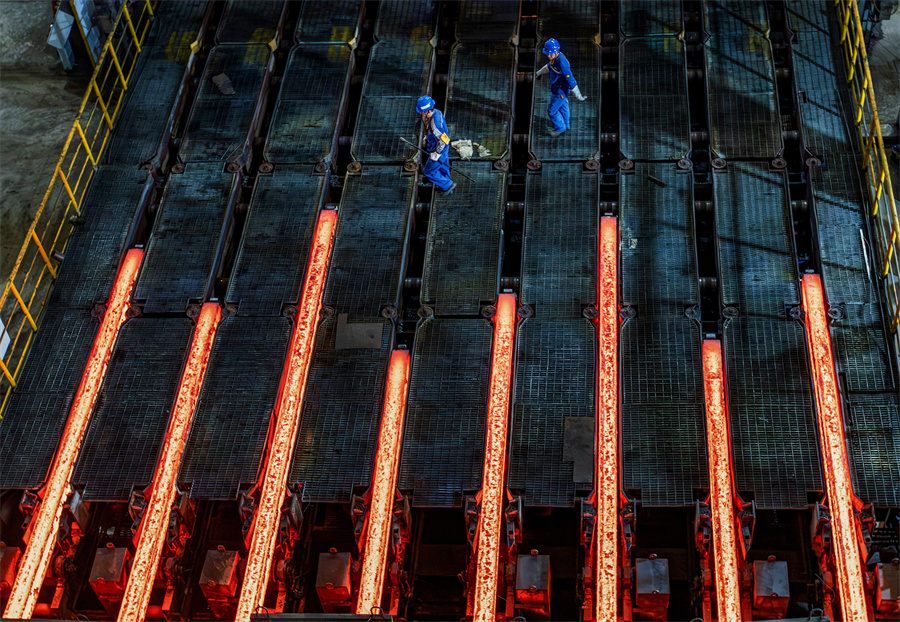

Workers manufacture steel products used in wind power structures in Ma'anshan, Anhui province, in August. [LUO JISHENG/FOR CHINA DAILY]

As one enters the gates of Pangang Group Xichang Steel and Vanadium Co Ltd, the steelmaking process is seamless — yet not a single worker is in sight.

The facility is immaculately clean, with every corner reflecting precision and order — offering a glimpse into the cutting-edge efficiency of modern steel plants across China.

China's steel industry has undergone low-carbon transformation and technological upgrades, implementing ultralow emissions retrofits and adjusting its production structure.

This has established a green industrial chain for the steel sector, actively contributing to its high-quality development.

"The industry is currently grappling with lower demand, which underscores the heightened importance of industry self-regulation. Since the beginning of this year (2024), the steel sector has had an obvious transition leading to a phase of reduced output and optimized existing capacity," said Jiang Wei, deputy Party secretary, vice-chairman, and secretary-general of the China Iron and Steel Association.

While overall steel consumption is trending downward, pockets of growth have emerged, accompanied by quality improvements in areas of expansion.

"Demand for steel in construction is declining, but is expected to see marginal improvement, and manufacturing has emerged as the primary driver of steel demand, with rapid growth in industries such as new energy, high-end equipment manufacturing and photovoltaics, significantly boosting demand for specific steel categories," Jiang said.

The share of steel demand from manufacturing is expected to increase further in the future, Jiang added.

In the first three quarters, China produced a total of 768 million metric tons of crude steel, a decrease of 3.6 percent year-on-year. The production of pig iron totaled 644 million tons, down 4.6 percent, and steel production reached 1.044 billion tons, a slight decline of 0.1 percent, said the CISA.

In 2023, the manufacturing and construction accounted for 48 percent and 52 percent of steel demand, respectively.

"It is projected that in 2024, the two sectors will share the market equally, with the share of steel demand from manufacturing potentially increasing even further," Jiang said.

Baoshan Iron and Steel Co Ltd has adjusted and optimized its steel product offerings to align with the evolving demands and trends of emerging manufacturing industries.

Electrical steel, also known as silicon steel, is one of Baosteel's strategic priorities. Since last year, the sector has undergone notable changes on the supply side, maintaining an overall growth trajectory, albeit at a slower pace, the company said.

The supply of grain-oriented silicon steel increased by over 20 percent year-on-year in 2023, but its growth rate slowed to around 5 percent in the first half of 2024. In contrast, the supply of non-oriented silicon steel maintained a steady growth rate of approximately 6 percent during the same period.

From a demand perspective, oriented silicon steel has maintained growth, driven primarily by the expansion of power grids, the construction of ultrahigh voltage transmission lines fueled by the development of renewable energy, and the growing energy storage market, said the company.

The growing popularity of new energy vehicles and the rapid expansion of charging infrastructure are reshaping the steel market, and these trends are fueling demand for materials tailored to energy systems, while the surging need for artificial intelligence computing power further amplifies this shift, said a company executive during a public briefing.

As for non-oriented silicon steel, policies encouraging appliance upgrades and the boom in NEV sales have provided additional momentum for the steel sector and the rise of the low-altitude economy has added a unique twist, sparking demand for ultrathin steel products, he said.

Workers at HBIS Group Shisteel hoist products onto a lorry for transport in Shijiazhuang, Hebei province, on Jan 2. [Photo/Xinhua]

In addition, challenges like a limited supply of thin gauge non-oriented silicon steel, especially 0.1-millimeter products, and stricter industrial motor efficiency standards highlight the need for continuous innovation in premium steel production, he added.

"In the current market environment, a company's competitiveness in the silicon steel sector will hinge on its product portfolio, manufacturing excellence, service capabilities, and research and development strength," said the company executive.

He added that looking ahead, the company will focus on enhancing its manufacturing excellence and service capabilities to better meet customer needs while strengthening its capacity for continuous research and innovation.

In addition to structural adjustments, green development is an indispensable element of sustainable growth for the steel industry, experts said.

On Nov 15, during COP29, the Policy Research Center for Environment and Economy, the Ministry of Ecology and Environment, in collaboration with Greenpeace — an international environmental organization — unveiled a report on the green and low-carbon transformation of high-carbon industries in the steel sector.

The report recommends that financial institutions expand their range of green transition financing tools and enhance financial support for the steel industry's green and low-carbon transformation.

The report also suggests that steel companies should seize the opportunities and challenges presented by the green and low-carbon transition, setting scientifically sound and reasonable low-carbon transformation goals, establishing clear and measurable carbon reduction targets and strengthening the planning and design of projects related to energy-saving and carbon-reducing technological upgrades.

The World Steel Association estimates that approximately 650 million tons of scrap steel are consumed globally each year, which helps reduce carbon dioxide emissions by around 975 million tons annually and significantly lowers the use of other natural resources, such as iron ore, coal and limestone, along with the associated production emissions.

Jiang said that China's steel industry has made continuous progress in advancing ultralow emission transformation projects and achieving extreme energy efficiency, with ongoing improvements in energy-saving and environmental protection indicators.

Shougang Group has taken the lead in achieving ultralow emissions across all processes, becoming the world's first company to reach full-process ultralow emissions. Since 2019, it has consistently been recognized as an A-level enterprise for environmental performance.

The company's self-designed and developed biomass charcoal and canister injection system has successfully completed a large-scale industrial trial of biomass-enriched hydrogen micro powder injections, marking China's first breakthrough in the use of biomass energy in steel metallurgy.

In addition, Shougang Group partnered with world-renowned metallurgical technology and equipment supplier Danieli Group to develop a near-zero carbon emission high-quality steel project, said Enterprise Observer, a weekly newspaper affiliated with the State-owned Assets Supervision and Administration Commission of the State Council.

Once completed, this project will feature the world's first production line with flexible coupling between an electric arc furnace and a converter, as well as the world's first electric arc furnace line for producing high-quality automotive steel and high-grade non-oriented silicon steel.

The green development of China's steel industry not only contributes to the country's environmental protection efforts, but also has the potential to support global environmental sustainability, said experts.

China remains the world's largest steel market, with annual consumption exceeding 800 million tons, and the manufacturing sector is emerging as a key driver for growth as the industry undergoes structural improvements, said CISA.

"China may not have been the first to focus on the green development of the steel industry, but its large industrial scale and vast market — or perhaps more accurately, its numerous application scenarios — make its efforts highly significant," said Xu Xiangchun, information director and analyst at iron and steel consultancy Mysteel.

Xu said that if China were to develop new technologies, the costs of research and development will be quickly offset once the technology is put into use, which is one of its major advantages.

Awareness of carbon reduction in China's steel industry is growing stronger, and companies are continuously exploring new paths, such as energy conservation, increasing the use of scrap steel, and adopting clean energy to transform the smelting industry, he said.

"In the future, China's steel industry has the capacity to lead global efforts in reducing carbon emissions, and this role will become increasingly evident in the years to come," Xu said.