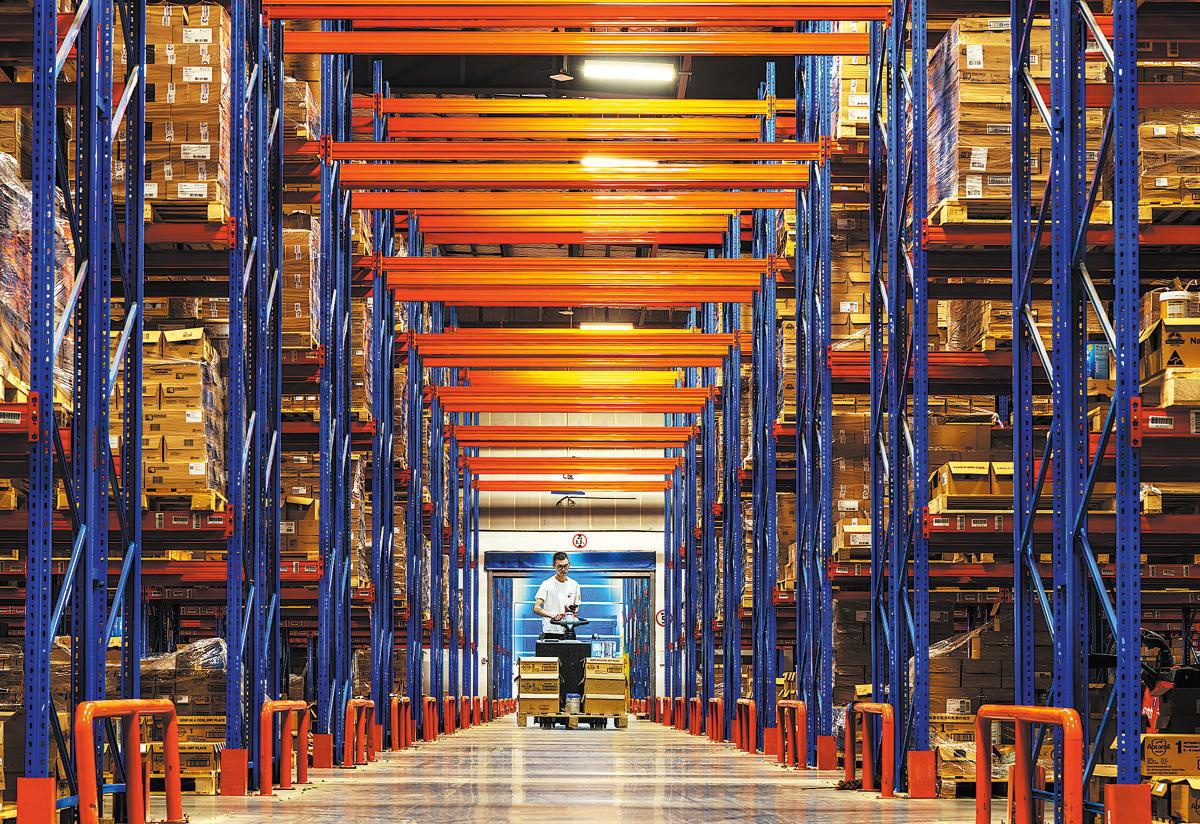

A warehouse worker moves cross-border e-commerce packages at the Jinyi Comprehensive Bonded Zone in Jinhua, Zhejiang province, on Oct 23. YANG HAIQING/FOR CHINA DAILY

During last year's Black Friday shopping spree, Xuchang wig seller Deng Nan was elated that year-on-year sales skyrocketed by 85 percent, due in no small part to his forward-looking sales strategy.

Black Friday fell on Nov 29, with sales boosted by cross-border e-commerce, and following strong retail figures for the Oct 31 Halloween celebrations.

"Consumers, in particular, used wigs to cosplay or participate in costume parties for the celebration of Halloween," Deng said.

"Wigs are not a necessity in China. But in overseas markets, they are regarded as a fashion symbol and an important and stylish accessory. Some consumers buy more than a dozen at a time," he said.

Xuchang, in Central China's Henan province, produces more than half of the world's wigs and is the leading global distribution and export center for such products. More than 300,000 locals work in wig-related industries in what's known as China's "hair factory".

Three years ago — seeing the growing demand for wigs abroad and aspiring to reach more overseas consumers — Deng began selling wigs through cross-border e-commerce platforms and registered with the fast-fashion online retailer Shein.

Foreign students sell products via a livestream during the 2024 China-ASEAN Education Cooperation Week in Guiyang, Guizhou province, on Aug 21. TAO LIANG/XINHUA

Deng designs and produces new products, and then determines whether to increase production in accordance with the latest sales and overseas market trends, instead of blindly manufacturing or stocking up on goods. His online store has experienced remarkable sales growth. About 40,000 wigs of various colors are currently sold every month, earning revenue of up to $2 million.

He is one of millions of young Chinese entrepreneurs cashing in on the emerging cross-border e-commerce platforms that offer a wide range of high-quality, affordable made-in-China products.

As a new form of foreign trade, cross-border e-commerce has become an important driving force boosting China's exports amid downward economic pressures and external uncertainties, experts said. Such trade is expected to play a pivotal role in promoting the digital transformation and upgrading of traditional industries, and the global push of Chinese-made products in 2025, they added.

The main advantage of cross-border e-commerce platforms lies in the flexible supply chain model, namely, small orders and quick responses, industry insiders said. This refers to using real-time market demand to regulate production,

Sellers start off with very small orders. If the sales trend is positive, they ramp up production, but if it falls short of expectations, production is reduced or halted.

On-demand production minimizes inventory and waste, improves operational efficiency and reduces costs, making the production process more flexible and enhancing a product's competitiveness, experts said.

A French exhibitor introduces a bottle of wine to a visitor at an import and export commodity fair in Hohhot, Inner Mongolia autonomous region, on Nov 14. DING GENHOU/CHINA DAILY

Robust growth

Fast-fashion online retailer Shein is boosting resources to help Chinese manufacturers expand their sales and presence in the global market.

In September 2023, the company announced plans to extend its outreach to industrial belts in 500 cities across China. Currently, it has more than 300 industrial belts covering over 20 categories including clothing, shoes, bags, jewelry, beauty care, electronic devices, and sports and outdoor products in more than 20 provincial-level regions nationwide.

Founded in Guangzhou, Guangdong province, and known for its low prices and large selection of fashionable clothing and accessories, Shein has gained traction among overseas shoppers. Shein was the most downloaded app in the fashion and beauty segment in the United States in 2023, registering more than 35 million downloads, data from global research firm Statista showed.

For sellers good at designing and producing products, but without overseas sales and operations experience, Shein provides one-stop services, including commodity operations, warehousing, logistics, and customer and after-sales service.

The company has announced further expansion of its product categories through collaborations with select global brands and third-party vendors to fulfill growing customer demand for diversified products.

Chinese cross-border e-commerce platforms can help establish a direct connection between manufacturers and consumers by applying advanced digital technologies such as big data, cloud computing and artificial intelligence, said Li Mingtao, head of the research institute at the China International Electronic Commerce Center.

"Many Chinese traditional manufacturers have gained an upper hand in production and quality control, but lack experience and capabilities in sales and operations, making it difficult for them to enter overseas markets," Li said.

Manufacturers should learn how to better grasp the needs of consumers via these platforms, adjust production, and reduce inventory, which will help improve the competitiveness of Chinese manufacturers globally, he added.

China's cross-border e-commerce industry has seen robust growth in recent years. The sector's imports and exports reached a record 1.88 trillion yuan ($257.6 billion) in the first three quarters of 2024, an increase of 11.5 percent year-on-year, data from the General Administration of Customs showed. E-commerce exports were 1.48 trillion yuan during this period, up 15.2 percent from a year earlier.

The country has accelerated steps to boost the development of new forms of foreign trade, and rolled out a series of policy measures that include establishing cross-border e-commerce comprehensive pilot zones, supporting the building of overseas warehouses and logistics infrastructure, and expanding the list of imported retail goods for cross-border e-commerce.

Exhibitors go on a live broadcast at the exhibition area of Alibaba.com during the 136th China Import and Export Fair in Guangzhou, Guangdong province, on Oct 15. LIU DAWEI/XINHUA

Gen Z favorite

Temu, the cross-border e-commerce platform launched by Chinese online discounter PDD Holdings, is speeding up its expansion into new markets. Launched in the US in September 2022, it has entered more than 70 countries in North America, Europe, Asia and Oceania.

Temu offers a wide selection of merchandise, including apparel, consumer electronics, jewelry, shoes, cosmetics, and baby products with deep discounts and coupons as part of its strategy to attract price-conscious consumers.

Most of the products are shipped directly from factories or warehouses in China.

According to the app analytics firm Appfigures, Temu has gained popularity among Gen Z consumers in the US, amassing an impressive 42 million downloads from users aged 18 to 24 in the first 10 months of 2024 alone. Apple recently confirmed it was the most-downloaded app in the US on its app store.

Chen Lei, chairman and co-CEO of PDD Holdings, said the company hopes to leverage the supply chain capacities it has accumulated in recent years to create a new channel that enables consumers from different countries and regions to directly purchase products from factories, providing more flexible and personalized supply chains and more cost-effective shopping experiences.

The platform provides a variety of services, including logistics, operations, promotional activities, aftersales services and legal affairs, while sellers just need to produce and ensure the quality of products.

Merchants promote products via livestreaming during the second Global Digital Trade Expo in Hangzhou, Zhejiang province, on Nov 23, 2023. XU YU/XINHUA

"As a new form of foreign trade, cross-border e-commerce has become an important driving force for bolstering the steady growth of foreign trade, as well as promoting the transformation and upgrading of the traditional manufacturing sector," said Zhang Zhouping, a senior analyst tracking business-to-business and cross-border activities at the Internet Economy Institute, a domestic consultancy.

Zhang said an increasing number of Chinese manufacturers are stepping up efforts to leverage cross-border e-commerce channels that feature innovative and flexible on-demand production models to expand their footprint abroad and build new brands.

By constantly monitoring market changes and collecting consumers' real-time feedback, these emerging platforms can make accurate predictions, while the flexible supply chain model is conducive to upgrading an entire industrial chain, ranging from design and development to production, warehousing and logistics, Zhang said.

The popularity of Chinese products in overseas markets demonstrates that these cost-effective goods have gained wide recognition and burnished the image of domestic brands abroad, he added.

Meanwhile, short-video app TikTok, owned by Chinese tech company ByteDance, has launched its e-commerce service, TikTok Shop, in the US. The service enables users to find and directly buy products featured in livestreaming broadcasts and short videos.

TikTok, which began rolling out e-commerce services in 2021 in Indonesia, has entered more than 10 countries, including the United Kingdom, Malaysia, Thailand, the Philippines and Vietnam. The e-commerce shop offers a wide range of products from clothes to electronics, and aims to tap into the potential purchasing power of TikTok's more than 150 million monthly active users in the US.

AliExpress, Alibaba Group's cross-border e-commerce platform, is accelerating its global push. It announced plans to offer subsidies worth 10 billion yuan to encourage more Chinese brands and merchants to sell overseas, and has expanded its global five-day delivery service to include several prominent markets in Europe through collaboration with Cainiao, Alibaba's logistics arm.

Cross-border e-commerce has become a driving force for innovation in global trade, said Cindy Tai, vice-president of Amazon and head of Amazon Global Selling Asia. She said China's cross-border e-commerce export industry is gaining momentum with huge development potential.

The company will help Chinese merchants improve the efficiency of supply chains and operations, leverage advanced generative artificial intelligence technology to enhance the sellers' experience, upgrade cross-border logistics and delivery services, as well as scale up localization inputs this year.

Visitors check out imported products at a trade expo in Langfang, Hebei province, in June. WANG MIN/XINHUA

Regulatory challenges

In 2024, the number of units sold by Chinese vendors to customers and businesses buyers on Amazon's global stores increased by over 20 percent year-on-year, data from Amazon showed.

Over the past two years, the number of Chinese sellers with sales surpassing $1 million on Amazon's global stores has increased by nearly 55 percent.

"Cross-border e-commerce platforms connect some key links covering procurement, sales and logistics, to provide a new and vital way for micro, small and medium-sized Chinese enterprises to expand their footprint abroad and create unprecedented new development opportunities," said Zhang Jianping, deputy director of the academic committee at the Chinese Academy of International Trade and Economic Cooperation.

The platforms are crucial in helping brands and manufacturers better grasp customer needs and quickly adjust product strategy and brand positioning, he added.

However, Chinese cross-border e-commerce platforms are facing mounting regulatory challenges in overseas markets amid rising trade protectionism and intensifying global competition.

The European Commission is studying a new tax on the revenues of online platforms and an administrative handling fee per item that would make most shipments less price competitive, according to recent media reports.

The commission also reportedly suggested scrapping a current 150-euro ($156) threshold under which items can be bought duty free. Under current EU regulations, packages purchased online from a non-EU country are not subject to customs duties if their value is under 150 euros.

The US government announced in September that it was moving to curb low-value shipments entering the US duty-free under the $800"de minimis" threshold that has been adopted by Chinese e-commerce firms.

A Shein spokesperson said in a statement that the company "makes import compliance a top priority, including the reporting requirements under US law with respect to de minimis entries".

Cui Lili, a professor of digital economy at Shanghai University of Finance and Economics, said Chinese online retailers who are making inroads into overseas e-commerce markets should quickly capture demand in overseas markets, have a deep understanding of relevant laws, regulations and quality standards in these countries, and adjust supply chains to make products that meet local requirements.

fanfeifei@chinadaily.com.cn