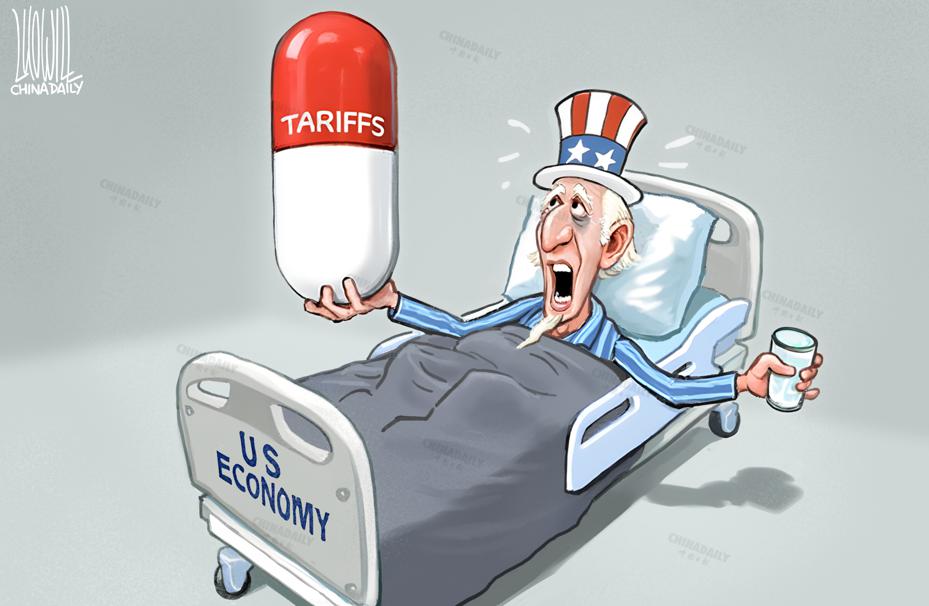

Editor's Note: On Wednesday, the Trump administration signed an executive order implementing "reciprocal tariffs" with a minimum baseline tariff of 10 percent and higher rates for certain trading partners, including China. Economists share their views with China Daily's Li Wei. Excerpts follow:

Luo Jie | China Daily

Impact likely to be stagflationary

The Trump administration's announcement of reciprocal tariffs is more severe than anticipated, signaling a sharp escalation in trade policy that could reshape the US economic landscape. If fully implemented, these measures would push the average tariff rate to 20-25 percent, a dramatic increase from the average effective tariff rate 2.4 percent seen in 2024. While exemptions for Canada, Mexico, and key industries—such as autos, steel, and energy—soften the blow somewhat, the broader implications remain concerning. The targeted tariff hikes, ranging from 10 percent to 49 percent, far exceed initial expectations and suggest a deliberate strategy to pressure trading partners into concessions.

The immediate economic impact is likely to be "stagflationary": higher prices coupled with slower growth. Inflation forecasts have been revised upward, with core personal consumption expenditures now expected to hit 4.7 percent by year-end, up from 3.5 percent. At the same time, GDP growth projections for Q4 have been slashed to 0.6 percent, down from 1.5 percent, while average NFP growth forecast lowered to 90,000 per month. The combination of rising costs and weaker demand raises the specter of recession, though the baseline scenario still assumes a continued expansion.

For the Federal Reserve, this presents a complex dilemma. While policymakers are expected to prioritize inflation control in the near term, the front-loaded nature of the tariff shock—along with mounting growth risks—could accelerate the timeline for monetary easing. Previously, no rate cuts were anticipated until mid-2026, but the new outlook suggests an initial cut in December 2025, followed by two more in early 2026. This shift reflects the growing likelihood that tariff-induced inflation will prove transitory.

Yet there is room for skepticism about whether these measures will be fully enforced. The Trump administration has a history of announcing sweeping tariffs only to walk them back after securing negotiated concessions. The current rollout, with staggered implementation dates and carve-outs for strategic allies, hints at a similar playbook—using the threat of protectionism as leverage rather than a fixed policy. The White House has already signaled openness to reducing rates in exchange for trade compromises or alignment on security priorities, reinforcing the view that these tariffs are as much a bargaining tool as an economic strategy.

David Seif is the chief economist for developed markets at Nomura; and Aichi Amemiya is the senior US economist at the same institute.

US tariffs fracture global markets

US President Donald Trump announced a dual-track tariff system of "minimum baseline and reciprocal surcharge" on Wednesday. Under this policy, a 10 percent "minimum baseline tariff" will be imposed on all trading partners, effective April 5, while higher reciprocal tariffs will be levied in a tiered manner on countries or regions with significant trade deficits with the US, including China (34 percent), the EU (20 percent), Japan (24 percent), South Korea (25 percent), India (26 percent), Vietnam (46 percent), and Thailand (36 percent), effective April 9.

While ostensibly framed as upholding so-called fair trade principles, the policy is fundamentally flawed. It violates the economic theory of comparative advantage. The core tenet of comparative advantage lies in maximizing global efficiency through specialization, whereas reciprocal tariffs artificially enforce tariff parity, disregarding objective differences in resource endowments.

The policy also contravenes WTO rules. The most-favored-nation principle prohibits discrimination among trading partners, requiring equal treatment for all members. This directly conflicts with the discriminatory nature of reciprocal tariffs.

The implementation of reciprocal tariffs will have profound implications for the global economy. The policy will immediately disrupt global supply chains and increase trade costs.

Once enacted, the US effective tariff rate will surge from 2.4 percent to 25.1 percent — the highest level since 1910. This "tariff nuclear bomb" will trigger a 40 percent spike in procurement costs for multinational supply chains, particularly in deeply integrated sectors such as automobiles, electronics, and machinery, forcing firms to restructure global production networks.

According to some estimations, US imports could plummet by 8.76 percent over the next three to five years, with global exports and imports declining by 2.33 percent and 2.46 percent, respectively. Supply chain fragmentation will heighten trade costs and undermine sustainable global trade.

Furthermore, the policy risks exacerbating global recession and regional inequality. The IMF has warned that policy uncertainty is already dampening global growth. A prolonged trade war could shrink global GDP by 7 percent—equivalent to the combined economies of France and Germany. Developing nations face disproportionate harm: India, Vietnam, and other export-dependent economies risk losing US market access due to tariff barriers, while African countries, stripped of special and differential treatment, will see their development prospects further constrained.

Additionally, reciprocal tariffs will accelerate inflation and impose a heavier burden on consumers. Yale University's budget lab projects that reciprocal tariffs will raise US personal consumption expenditure prices by 1.7 percent in the short term if no retaliation occurs, or 2.1 percent and higher if retaliatory measures are taken. This translates to $3,400–4,200 in additional annual costs for the average American household to maintain living standards—a severe blow to consumer welfare.

At a critical juncture for global economic recovery, Trump's reciprocal tariffs epitomize a zero-sum mentality. Their short-term political gains pale against long-term economic damage, exacerbating trade tensions, triggering retaliatory measures, fracturing global markets, and ultimately jeopardizing international economic security and stability.

Lyu Yue is the executive dean of the Academy of Global Innovation and Governance, University of International Business and Economics.