Hong Kong has top high-tech research and development institutions. It lacks the Fourth Industrial Revolution innovation partners. As manufacturing left in the 1990s, the city excelled in entrepot trade, supply-chain logistics, finance and tourism. Should it reinvent itself as an expanded innovation and technology hub with Shenzhen? Oswald Chan reports from Hong Kong.

INFOGRAPHICS: DONG KAI, MOK KWOK-CHEONG

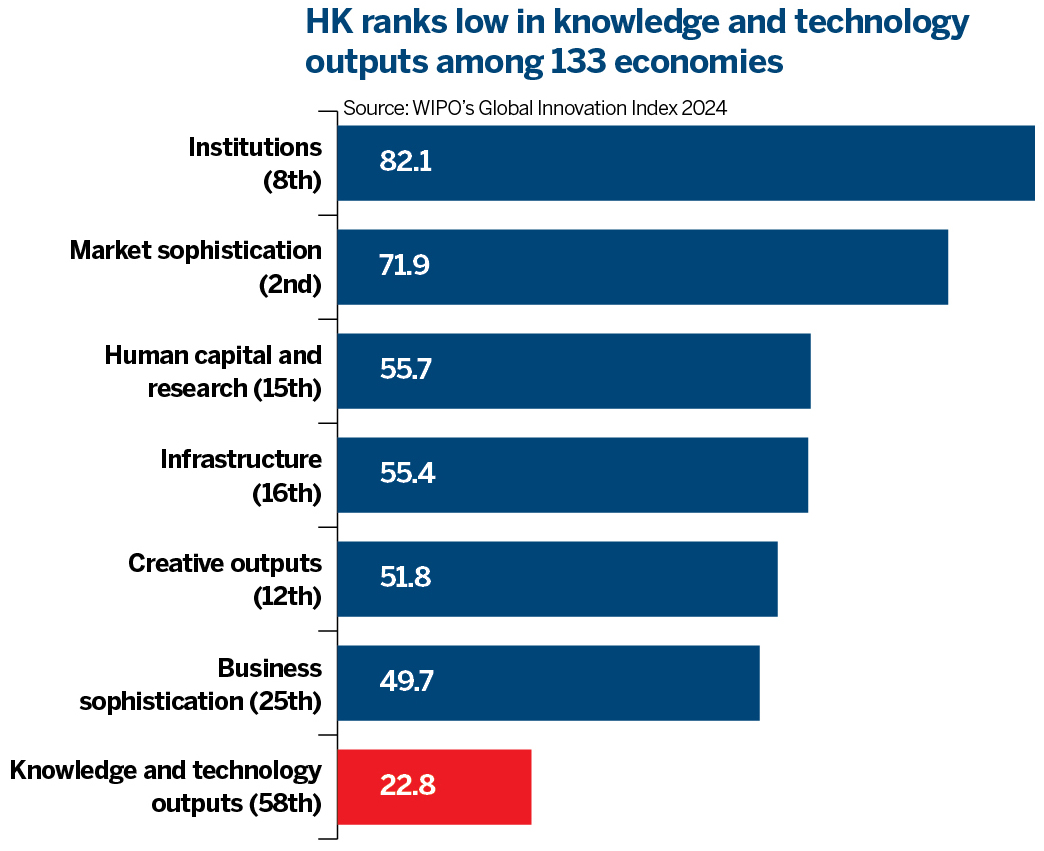

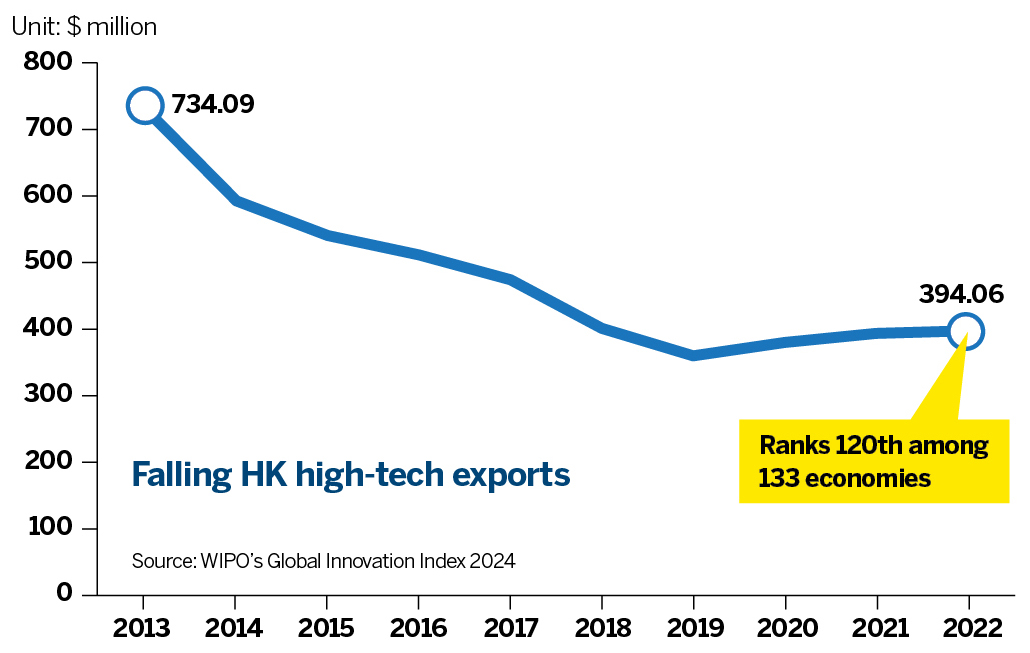

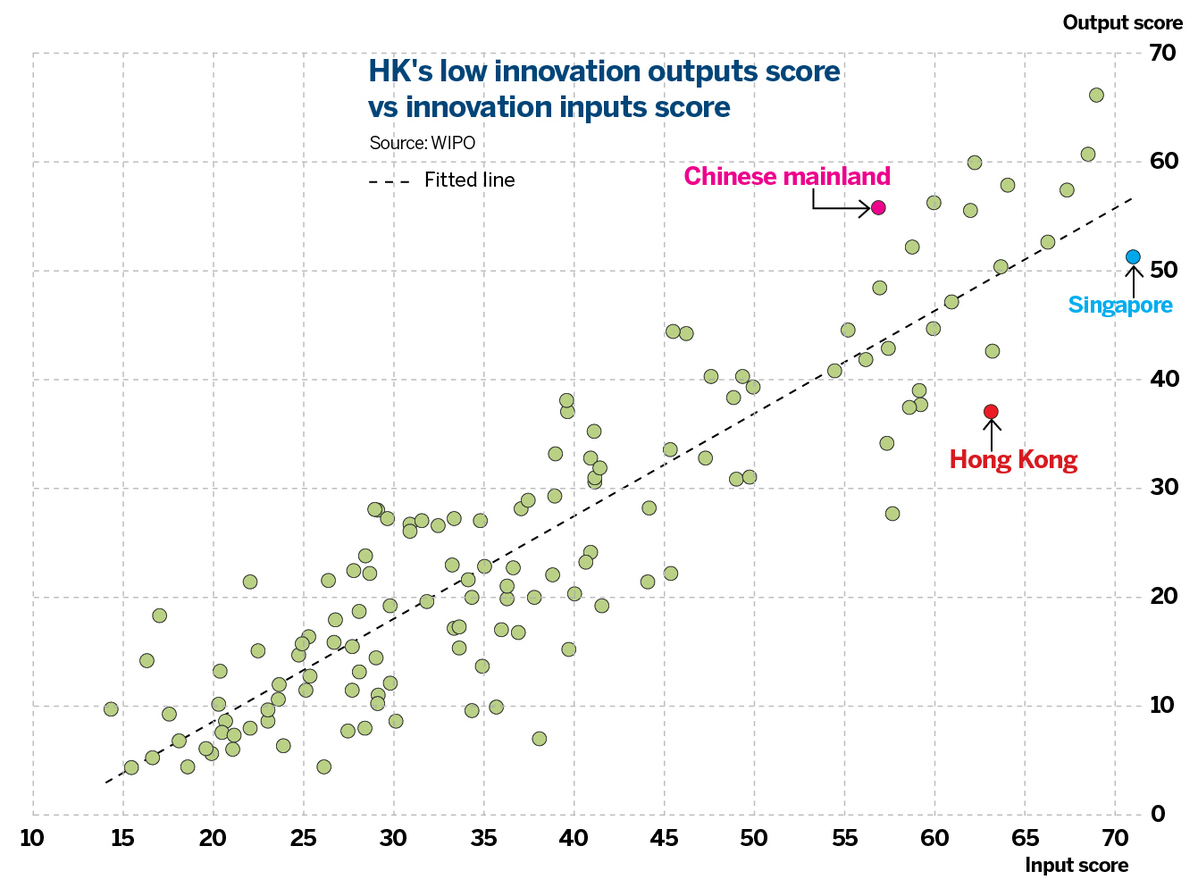

The Hong Kong Special Administrative Region allocated a substantial HK$200 billion ($25.7 billion) for innovation and technology (I&T) development. The weak link in its ecosystem for I&T is its "knowledge and technology outputs" as identified by the World Intellectual Property Organization (WIPO), citing a deficiency in technology commercialization: "The city has not yet been able to translate costly innovation investments effectively into more and higher-quality outputs. ... It produces less innovation outputs relative to its level of innovation investments."

WIPO monitors 133 economies across 80 indicators of innovation, grouped into innovation inputs and outputs, to rank subjects. It sums its matrix of innovation into a net index.

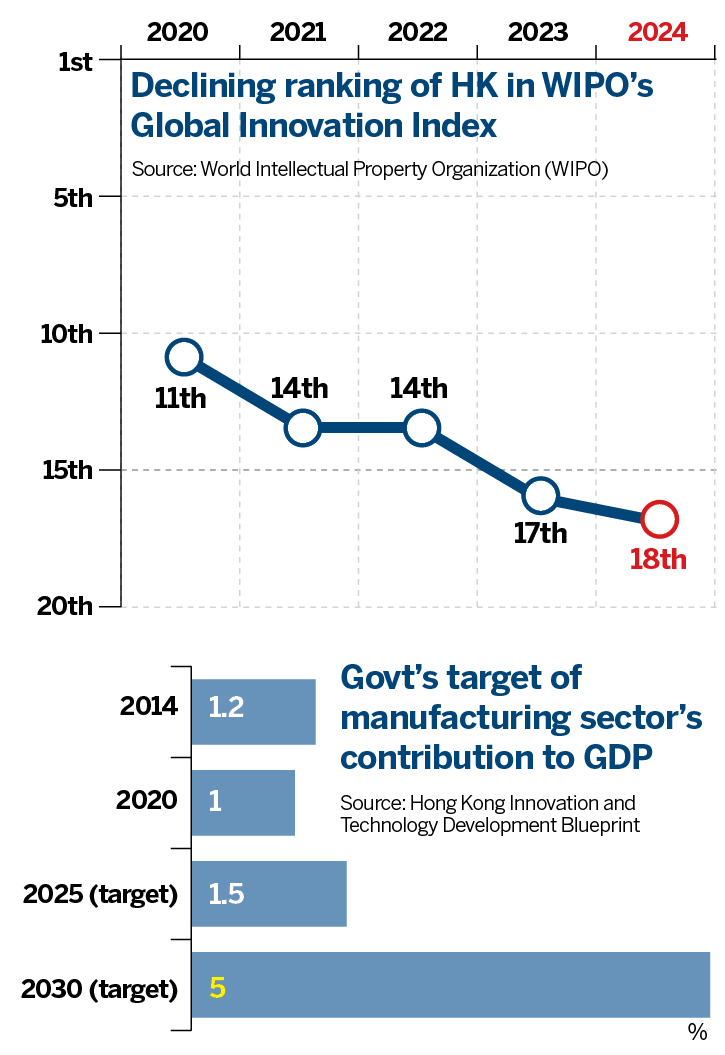

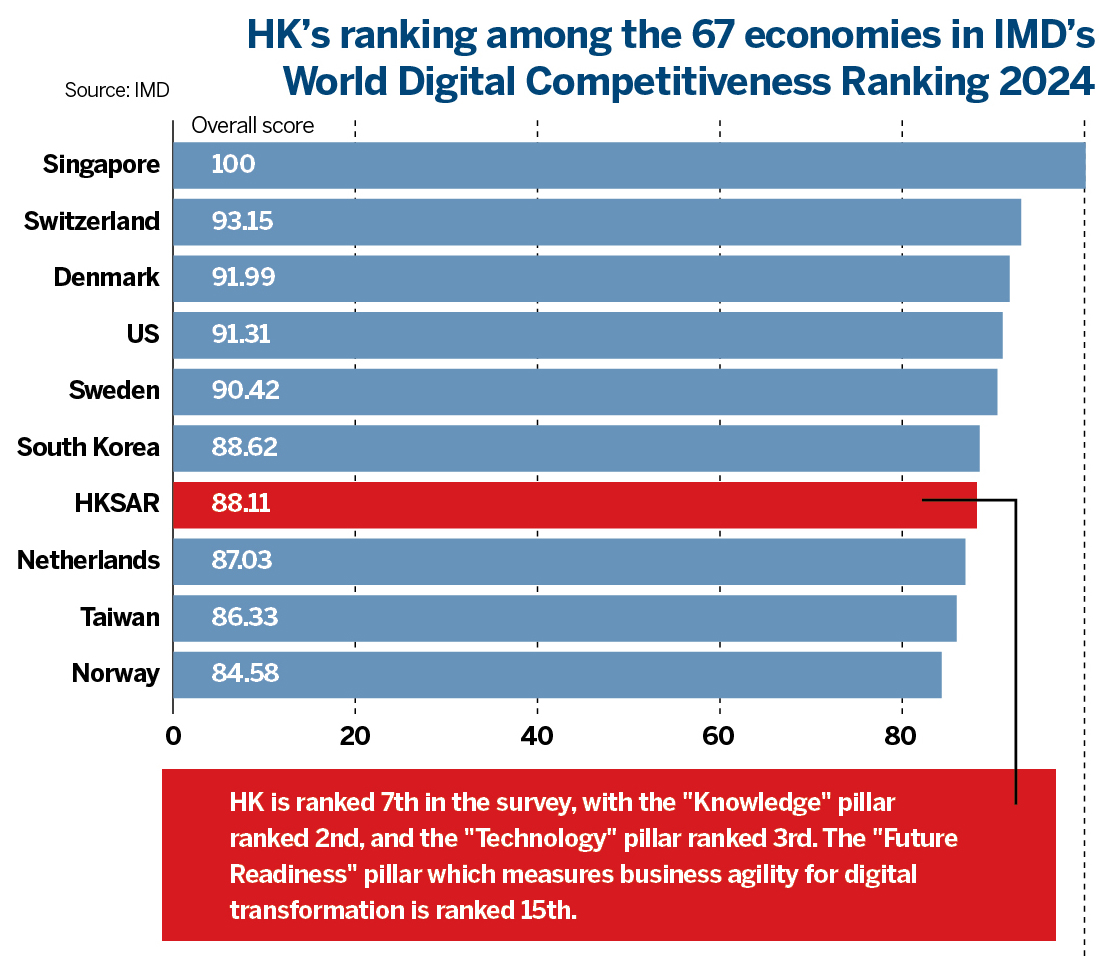

Hong Kong's ranking dropped over half-a-decade from 11th in 2020 to 18th this year, in both innovation inputs and outputs. For the 2024 WIPO list, Singapore (fourth) and South Korea (sixth) are in the top 10, above Germany (ninth). Japan (13th) is out of the top 10. The Chinese mainland (11th) stands next to Denmark (10th).

Hong Kong performed poorly for "business sophistication" and "infrastructure", with "knowledge and technology outputs" ranking lowest. It did well in indicators for "market sophistication", "institutions", "creative outputs" and "human capital and research".

It is a moot point whether the city should redefine its I&T ambitions beyond itself, as a fully integrated joint hub with the high-tech showcase of Shenzhen. The reality is that manufacturing capacity has left Hong Kong, and the center of gravity for technology innovation is firmly anchored in the leading universities of Beijing, and State-directed technology companies. Technology testing and prototyping is implemented in the high-tech base of Shenzhen. Hong Kong continues to be the financial center for startups to raise equity.

Patent leverage

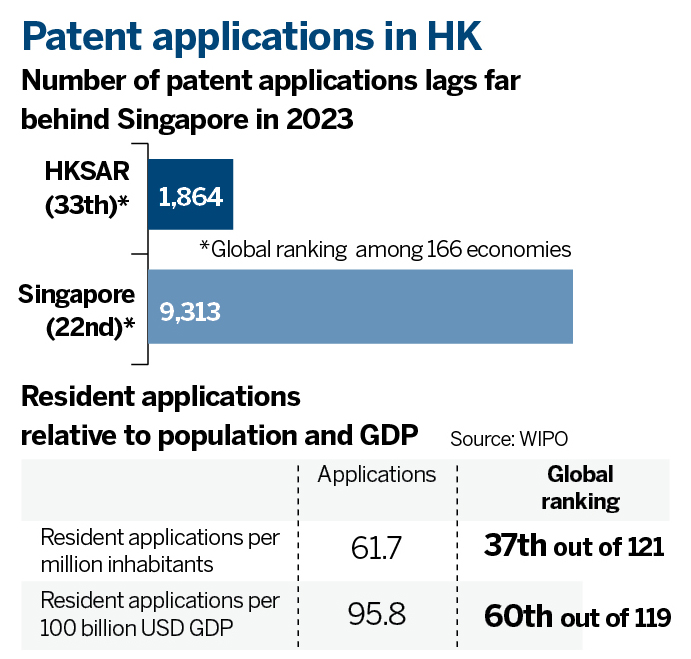

Hong Kong universities do not prioritize technology transfer activities. Patent ownership is hogged by the institutions with inadequate revenue-sharing to incentivize commercialization. Technology transfer receives limited academic recognition. The academic reluctance to fully embrace technology commercialization prevented Hong Kong from being a significant player in the Third and Fourth Industrial Revolutions.

After China joined the World Trade Organization in 2001, the mainland's reliance on Hong Kong diminished, while it accelerated rapidly into the technology leadership in artificial intelligence, big data, quantum computing, and biotechnology. The mainland sees these initiatives as vital to its sovereign options through the 21st century.

Tang Hei-wai, a Victor and William Fung economics professor at the HKU Business School, argues that creating market demand for technology commercialization is vital. "Hong Kong does not have a solid industrial base, which hinders technology commercialization. Even technology testing may not have the chance to get conducted here."

That situation can be corrected by attracting strategic enterprises, providing capital matching and long-term capital. The Office for Attracting Strategic Enterprises has enticed 50 strategic enterprises to establish here, expecting to bring over HK$42 billion in investments to create 17,000 jobs in the coming years.

"When there are more strategic enterprises established here, they create high-end technology positions for homegrown and overseas talent in basic science and applied science, thus fostering technology commercialization," says Tang.

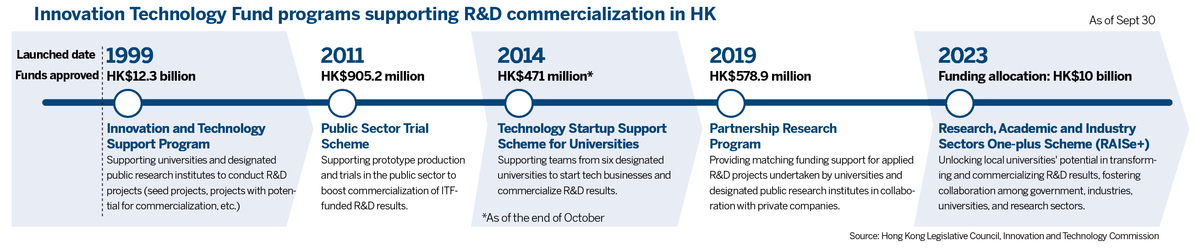

The SAR government's HK$10 billion "Research, Academic and Industry Sectors One-plus Scheme" (RAISe+ Scheme) in October 2023 is another boost offering funding on a matching basis up to 2 (government) to 1 (industry and university).

The administration expects research and development (R&D) commercialization outcomes from at least 100 research teams of universities in Hong Kong in the next five years. The program's steering committee so far has recommended 24 research teams to join the first batch of projects, in which university teams or inventors would be entitled to 70 percent of the intellectual property (IP) benefits.

Duncan Chiu Tat-kun, a member of the Legislative Council for the Technology and Innovation functional constituency, lauds the RAISe+ Scheme as a generous financial support program: The government will not take equity in, nor require loan repayments, from the startups.

But the lawmaker recommends the program be widened: "By allowing cooperation between local and overseas technology research teams to apply funding, we can attract overseas technology research projects with good commercialization potential."

Hong Kong Investment Corp Ltd, the city's government-owned wealth fund with investable capital of HK$62 billion, aims to cement an I&T ecosystem and industry value chain in three sectors - biotech, new energy/green technology, and hard and core technology - by deploying long-term capital.

Since the middle of this year, HKIC has sealed four strategic cooperation agreements with homegrown AI and intelligent manufacturing unicorn SmartMore Corp Ltd, biocomputing model generator BioMap, AI startup Galbot Co, and homegrown Cornerstone Technologies-backed Spark EV Co. The four investee companies commit to international innovation centers in Hong Kong and prioritize training local professionals to spur technology commercialization.

Kenny Shui Chi-wai, vice-president and co-head of research at Our Hong Kong Foundation (OHKF), adds the administration can do more in financial incentives, besides committing venture capital investment. It can mull income tax relief, or loss relief to address venture capital investors' aversion to risk. Slashing corporate tax rates from the existing 16.5 percent for profits above HK$2 million to 5 to 15 percent can enhance startups becoming unicorns and strategic enterprises, thus boosting demand for technology commercialization.

Market scale

Even with elevated tech commercialization capacity, the second lever of regional collaboration is required - the size of the market.

"The Hong Kong market is not viable enough. The city must leverage the professional, capital resources, manufacturing and technology capacity in the Guangdong-Hong Kong-Macao Greater Bay Area to accelerate economies of scale in technology commercialization," says Tang, who is also the associate director of the Hong Kong Institute of Economics and Business Strategy.

Accelerating the Greater Bay Area regional collaboration needs spatial planning that connects all the required resources. Lawmaker Chiu tells China Daily: "Geographic proximity is important for a platform to network professional, capital and strategic enterprises. The Northern Metropolis can provide the space to aggregate all these inputs in the future."

The SAR government envisages the Hong Kong Park of the Hetao Shenzhen-Hong Kong Science and Technology Innovation Cooperation Zone to be the industry-academia-research platform for transforming R&D results, and as a pilot production base for industries.

The lawmaker advocates the technology parks within San Tin Technopole in the Northern Metropolis to be connected to the Hong Kong Park and Shenzhen Park of Hetao Cooperation Zone with seamless cross-boundary flows of professional, logistics, data and capital, for a comprehensive I&T hub, like the Singaporean "one-north" model.

Situated in the Queenstown area of Singapore, one-north exhibits strong connectivity in I&T development by aggregating government and university research offices, business offices, startup entrepreneurs, incubators, accelerators, training institutes, and even manufacturing facilities, in one geographical location.

Institutional reform

With tech commercialization and the Greater Bay Area's coordinated development, institutional revamping is the third lever.

"There remain significant gaps in knowledge transfer that the government and universities must address to transform Hong Kong's world-class basic research into viable products. Hong Kong universities trail behind in the flexibilities and options of institutional IP policy, stifling the IP mobilization and thus hindering knowledge transfer and research commercialization," Shui tells China Daily.

Across a broad range of knowledge transfer indicators, such as the number of patents granted, the cumulative number of active spin-off companies, and the combined total income from IP rights, universities in Hong Kong are behind their foreign peers, such as the University of Oxford, Harvard University, Stanford University, and the Massachusetts Institute of Technology, says think tank OHKF.

Shui urges universities in Hong Kong to implement transparent guidelines and flexible policies on patent ownership and buyouts; for example, determining the buyout price based on registration and attorney fees. The researcher advocates for universities to adopt more generous proprietary terms in revenue-sharing policies, and consider more flexible financial terms to support spinoff companies, such as accepting a smaller share of equity as licensing fee payment. He also suggests flexible practice regulations such as expanding the hours available for knowledge transfer activities, at least during holidays and annual leave.

The University of Hong Kong and the Hong Kong University of Science and Technology have announced that the patent income share for inventors has been raised to 70 percent.

More diverse minds

On the collaboration mechanism, OHKF's Shui recommends introducing more external members and professionals for a more diverse pool, since technology transfer offices (TTOs) and the committees that supervise them in Hong Kong universities, lack external representation compared to world-leading universities.

"Besides TTOs, we also need technology transfer alliances that can bundle inventions across universities, lower operation costs, access personnel with commercialization expertise, and develop university-industry networks for technology transfer," adds Shui.

Philip Law Yuen-kong, the Southern Region venture capital and private equity leader at Deloitte China, recommends Hong Kong emulate the Singaporean model when formulating collaboration mechanisms.

The Agency for Science, Technology and Research (A*STAR) in Singapore is a statutory board under the Ministry of Trade and Industry, tasked with developing the required I&T manpower, undertake R&D, and to monetize R&D outcomes.

"Singapore has the A*STAR that bridges academic universities and business entrepreneurs. Hong Kong should explore such a technology incubation model by injecting more commercial support into the technology commercialization process," Law says.

R&D tracking

When R&D commercialization is accelerated, hastening regional collaboration and overhauling the institutional framework, a comparative database detailing universities' activities in commercialization, industry collaboration, and local development is essential to provide measurable indicators of technology commercialization.

"There should be a comprehensive innovation policy in the first place to include specific kinds of measurement. There must be a portfolio of measurable outcomes, such as investment value, job creation and output generation, instead of just patent filings and academic papers. There should also be flexibility when applying the key performance indicators (KPIs) since different R&D stages require different measurements," Tang tells China Daily.

Lawmaker Chiu says the KPI principle should be based on the whole Greater Bay Area region. "The measurement should track I&T achievement for the whole Greater Bay Area region in a long-term span of five to 10 years. KPIs focusing on short time-spans and confined only to Hong Kong are not a useful framework for measurement," Chui says.

OHKF's Shui recommends that the University Grants Committee in Hong Kong reference the Higher Education Statistics Agency and Knowledge Exchange Framework in the United Kingdom, as well as the QS Stars University Ratings, to fill the gaps of knowledge transfer KPIs in its university accountability agreements signed with UGC-funded universities.

Contact the writer at oswaldchan@chinadailyhk.com